Range-bound/bear traps

ATMGRUPA has been consolidating in a wide range between 200 and 265 since june this year and hardly even reacted to the market's july sharp decline, producing a bear trap, which indicated that this consolidation is a bullish/continuation pattern. Last week it tested all-time highs after a breakout from a little flag pattern, but then on friday it sharply declined, found support on the rising 100-day moving average and finally came back leaving a spike at the end of the day. My concern about this stock is that there's very low trading activity going on lately, which suggests, that we will probably have to wait a little bit longer until it can break past these all-time highs and advance further.

ATMGRUPA has been consolidating in a wide range between 200 and 265 since june this year and hardly even reacted to the market's july sharp decline, producing a bear trap, which indicated that this consolidation is a bullish/continuation pattern. Last week it tested all-time highs after a breakout from a little flag pattern, but then on friday it sharply declined, found support on the rising 100-day moving average and finally came back leaving a spike at the end of the day. My concern about this stock is that there's very low trading activity going on lately, which suggests, that we will probably have to wait a little bit longer until it can break past these all-time highs and advance further. BRE looks even stronger, though we haven't seen actual test yet, but it's already found support on the rising 100-day moving average, confirming a third in a row higher low. This is definitelly a sign of strength - the buyers are getting more aggressive. My only concern is that the 100-day MA has already been double tested. Often, the more support/resistance is tested, the more it is likely to fail, so let's see if the stock can bounce off this moving average and countinue to rally.

BRE looks even stronger, though we haven't seen actual test yet, but it's already found support on the rising 100-day moving average, confirming a third in a row higher low. This is definitelly a sign of strength - the buyers are getting more aggressive. My only concern is that the 100-day MA has already been double tested. Often, the more support/resistance is tested, the more it is likely to fail, so let's see if the stock can bounce off this moving average and countinue to rally. The last one for upcoming week is MOSTALWAR. August bear trap proved to be a rejection of the sharp top, which formed early in may this year. Recently the stock has been testing the nearest resistance level, as shown on the chart. Although last candle shows that the price closed above the line, but we haven't seen actual breakthrough on increased volume. In fact the last candle formed a hammer or hanging man, which is a sign of stall or even reversal. I'd suggest to wait maybe until the price finds support on the level of resistance, which is recently tested. That would give much clearer picture and a reason to get bullish in this stock.

The last one for upcoming week is MOSTALWAR. August bear trap proved to be a rejection of the sharp top, which formed early in may this year. Recently the stock has been testing the nearest resistance level, as shown on the chart. Although last candle shows that the price closed above the line, but we haven't seen actual breakthrough on increased volume. In fact the last candle formed a hammer or hanging man, which is a sign of stall or even reversal. I'd suggest to wait maybe until the price finds support on the level of resistance, which is recently tested. That would give much clearer picture and a reason to get bullish in this stock.1-2-3 reversals

The following stocks show price movement, that is considered as a common reversal pattern.

First one is CASHFLOW, which tested december breakout level in mid august and since then has made a rally, followed by a higher low and finally ended up forming a flag pattern near the previous high level. That pattern has established after a bullish gap, which hasn't been filled yet. Moreover, the price remained above moving averages, which are crossing each other recently and are about to retrim the upslope. Flag is always a continuation pattern, so staying above the gap level will prove to be a sign of strength. If it fails and closes below the moving averages, then I would consider putting on more defensive stance in this stock.

First one is CASHFLOW, which tested december breakout level in mid august and since then has made a rally, followed by a higher low and finally ended up forming a flag pattern near the previous high level. That pattern has established after a bullish gap, which hasn't been filled yet. Moreover, the price remained above moving averages, which are crossing each other recently and are about to retrim the upslope. Flag is always a continuation pattern, so staying above the gap level will prove to be a sign of strength. If it fails and closes below the moving averages, then I would consider putting on more defensive stance in this stock. ECHO chart shows similar situation, though with even stronger and more precise confirmation. Since the retest of prior breakout level, we have seen a pattern of higher highs and higher lows, which ended up as a flag in the 90,00 area, also above crossing moving averages. Breakdown below flag's support will also change my stance to more defensive in this stock.

ECHO chart shows similar situation, though with even stronger and more precise confirmation. Since the retest of prior breakout level, we have seen a pattern of higher highs and higher lows, which ended up as a flag in the 90,00 area, also above crossing moving averages. Breakdown below flag's support will also change my stance to more defensive in this stock. Another stock matching "1-2-3" criteria is EFEKT, which looks the same as ECHO. The only difference is that it formed a pennant or narrowing triangle and it's already tested the 100-day moving average, which we haven't seen in the previous cases. So the buyers are even more aggressive in this one. The 10-day moving average is above 20-day moving average, which is above 50-day moving average (just got there on friday). Break beyond 37,00 could lead to yet another retest of all-time highs near 45,00.

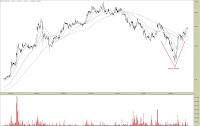

Another stock matching "1-2-3" criteria is EFEKT, which looks the same as ECHO. The only difference is that it formed a pennant or narrowing triangle and it's already tested the 100-day moving average, which we haven't seen in the previous cases. So the buyers are even more aggressive in this one. The 10-day moving average is above 20-day moving average, which is above 50-day moving average (just got there on friday). Break beyond 37,00 could lead to yet another retest of all-time highs near 45,00. GETIN is more choppy and it can be seen on the chart, that it doesn't act as precise as the other three candidates, which also indicates, that it's more risky. Confirmation of 1-2-3 bottom will occur after braking above 13,80 level, which also happens to be previous support (may 2007).

GETIN is more choppy and it can be seen on the chart, that it doesn't act as precise as the other three candidates, which also indicates, that it's more risky. Confirmation of 1-2-3 bottom will occur after braking above 13,80 level, which also happens to be previous support (may 2007). KREZUS is also about to confirm 1-2-3 bottom reversal, which will occur after breaking above the resistance line shown on the chart. One should be very careful playing this, because this stock is very aggressively traded, as we can see by sharp moves either way around the overnight gaps. Remember to check when the earnings report is due before getting into this stock. So far the price action favours the bulls.

KREZUS is also about to confirm 1-2-3 bottom reversal, which will occur after breaking above the resistance line shown on the chart. One should be very careful playing this, because this stock is very aggressively traded, as we can see by sharp moves either way around the overnight gaps. Remember to check when the earnings report is due before getting into this stock. So far the price action favours the bulls.Various

Other notable patterns.

HANDLOWY has recently shown an inverted head and shoulders pattern, which is not actually confirmed yet, because price is still below the potential neckline. Though it has recently found support on the 50-day moving average, confirming another higher high and thus showing more strength. Breaking above the neckline will prove to be a comeback to the major uptrend with an upside target of 140,00.

HANDLOWY has recently shown an inverted head and shoulders pattern, which is not actually confirmed yet, because price is still below the potential neckline. Though it has recently found support on the 50-day moving average, confirming another higher high and thus showing more strength. Breaking above the neckline will prove to be a comeback to the major uptrend with an upside target of 140,00. MEDIATEL formed sharp bottom, which is a common indicator of trend reversal, and it's proved to be such since the late august. The price remained above all moving averages, which are pointing up again. The nearest upside target is probably around 16,50 or 17,00 (depends on which prior resistance you consider), then we will probably see a pullback to retest the rising longer term moving averages (50- and 100-day).

MEDIATEL formed sharp bottom, which is a common indicator of trend reversal, and it's proved to be such since the late august. The price remained above all moving averages, which are pointing up again. The nearest upside target is probably around 16,50 or 17,00 (depends on which prior resistance you consider), then we will probably see a pullback to retest the rising longer term moving averages (50- and 100-day).